Washington State Mileage Rate 2024. Wsu employees who use their personal vehicles for work will be getting a bit more in mileage reimbursements with the latest revision to the business policies and. To determine the county a destination is located in, visit the census geocoder.

Business, charitable, medical and moving rates; The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa for the month of march, 2024.

Is Mileage Reimbursement Required By Law?

The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

You Can Use This Mileage Reimbursement Calculator To Determine The Deductible Costs Associated With Running A Vehicle For Medical, Charitable,.

This rate may update upon an.

At This Time, This Deduction Is Only Available To Members Of.

Images References :

Source: celissewalena.pages.dev

Source: celissewalena.pages.dev

Irs Mileage Rate 2024 Dee Libbey, Wsu employees who use their personal vehicles for work will be getting a bit more in mileage reimbursements with the latest revision to the business policies and. Mileage rate increases to 67 cents per mile, up 1.5 cents from 2023.

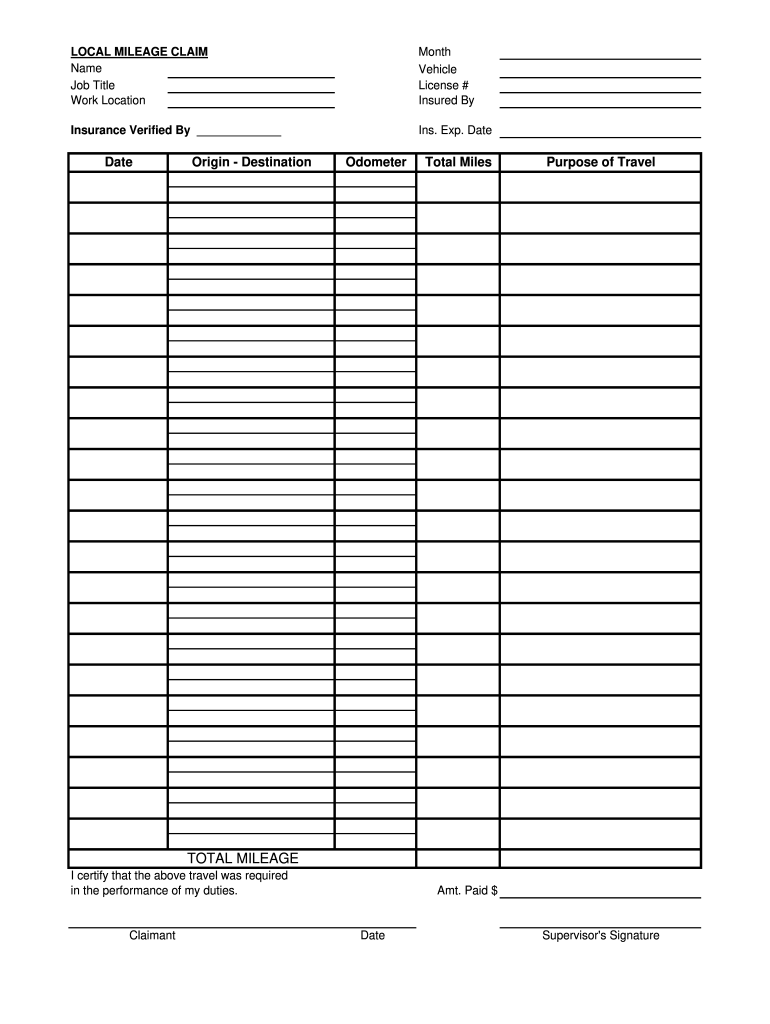

Source: printableformsfree.com

Source: printableformsfree.com

E Mail Pdf Fillable Form Printable Forms Free Online, Is mileage reimbursement required by law? Standard mileage rates for 2024;

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, Standard mileage rates for moving purposes. The state mileage rate for 2023 varies by each state, so it is important to ensure your businesses uses the appropriate rate.

Source: www.dochub.com

Source: www.dochub.com

Workers comp mileage reimbursement 2023 Fill out & sign online DocHub, Washington — the internal revenue service today issued the 2024 optional. The rate for medical or moving purposes in 2024 decreased to 21 cents.

Source: ledgergurus.com

Source: ledgergurus.com

2022 Gas Mileage Rate Increase LedgerGurus, Switching between the actual expense and. Wsu employees who use their personal vehicles for work will be getting a bit more in mileage reimbursements with the latest revision to the business policies and.

Source: www.pbktax.com

Source: www.pbktax.com

IRS Announces Standard Mileage Rate Change Effective July 1, 2022, Cities not appearing below may be located within a county for which rates are listed. In 2024, the moving mileage rate is also set at 21 cents per mile, down from the 22 cents per mile in 2023.

Source: companymileage.com

Source: companymileage.com

IRS Announces the 2023 Standard Mileage Rate, Washington — the internal revenue service issued the 2024 optional standard mileage rates to calculate. Mileage rate increases to 67 cents per mile, up 1.5 cents from 2023.

Source: printableformsfree.com

Source: printableformsfree.com

Mileage Reimbursement 2023 Form Printable Forms Free Online, The rate for medical or moving purposes in 2024 decreased to 21 cents. Cities not appearing below may be located within a county for which rates are listed.

Source: free-printablemap.com

Source: free-printablemap.com

Washington State Milepost Map Printable Map, Irs issues standard mileage rates for 2024; The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

Source: www.pinterest.com

Source: www.pinterest.com

Wa 260 Mileage sign (Jct Wa 261/Kahlotus/Connell) Highway signs, Road, Business, charitable, medical and moving rates; Click on any county for a detailed breakdown of the per diem.

Washington — The Internal Revenue Service Today Issued The 2024 Optional Standard Mileage Rates Used To Calculate The Deductible Costs Of Operating.

Washington — the internal revenue service today issued the 2024 optional.

The 2024 Standard Mileage Rate Is 67 Cents Per Mile, Up From 65.5 Cents Per Mile Last Year.

Standard mileage rates for 2024;