Mass Inheritance Tax 2024. This change will eliminate the estate tax filing requirement for decedents with taxable estates valued at less than $2 million (including property owned in other states). There have been recent law changes to the estate tax for decedents dying on or after january 1, 2023.

As of 2023, only five states impose an. The new law amended the estate tax by providing a credit of up to $99,600, thereby eliminating the tax for estates valued at $2 million or less.

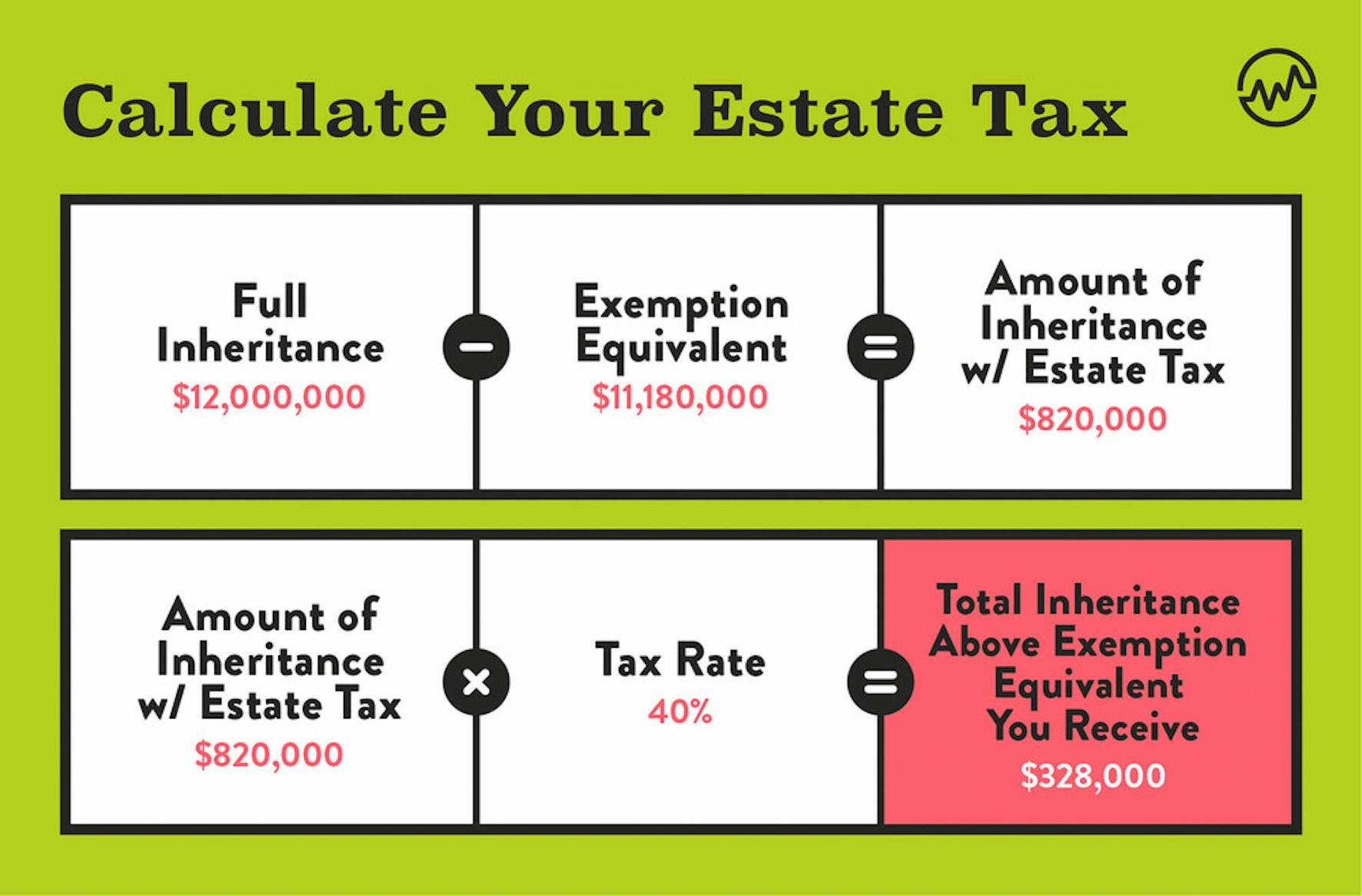

An Estate With A Taxable Estate Of $1,000,000 Could Pay No Tax, While An Estate With A Taxable Estate Of $1,100,000 Could Pay Estate Taxes Of $38,800, Resulting In The Estate.

What to know about the recent change to the massachusetts estate tax.

In 2023, Massachusetts Finally Increased Its Estate Tax Threshold, Although Barely.

They were not taxed either during life or at death.

In Contrast, An Inheritance Tax Is Imposed On The Individual Inheriting The Assets, And It Is The Beneficiary Or Heir Who Must Pay This Tax.

Images References :

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, In a significant move, the massachusetts legislature has voted. The inheritance tax is due eighteen months after death.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, January 10, 2024 | insights; Significant changes to the massachusetts estate tax, capital gains tax and massachusetts millionaires tax were signed into law by gov.

Source: wealthfit.com

Source: wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, This change will eliminate the estate tax filing requirement for decedents with taxable estates valued at less than $2 million (including property owned in other states). Significant changes to the massachusetts estate tax, capital gains tax and massachusetts millionaires tax were signed into law by gov.

Source: alhambrapartners.com

Source: alhambrapartners.com

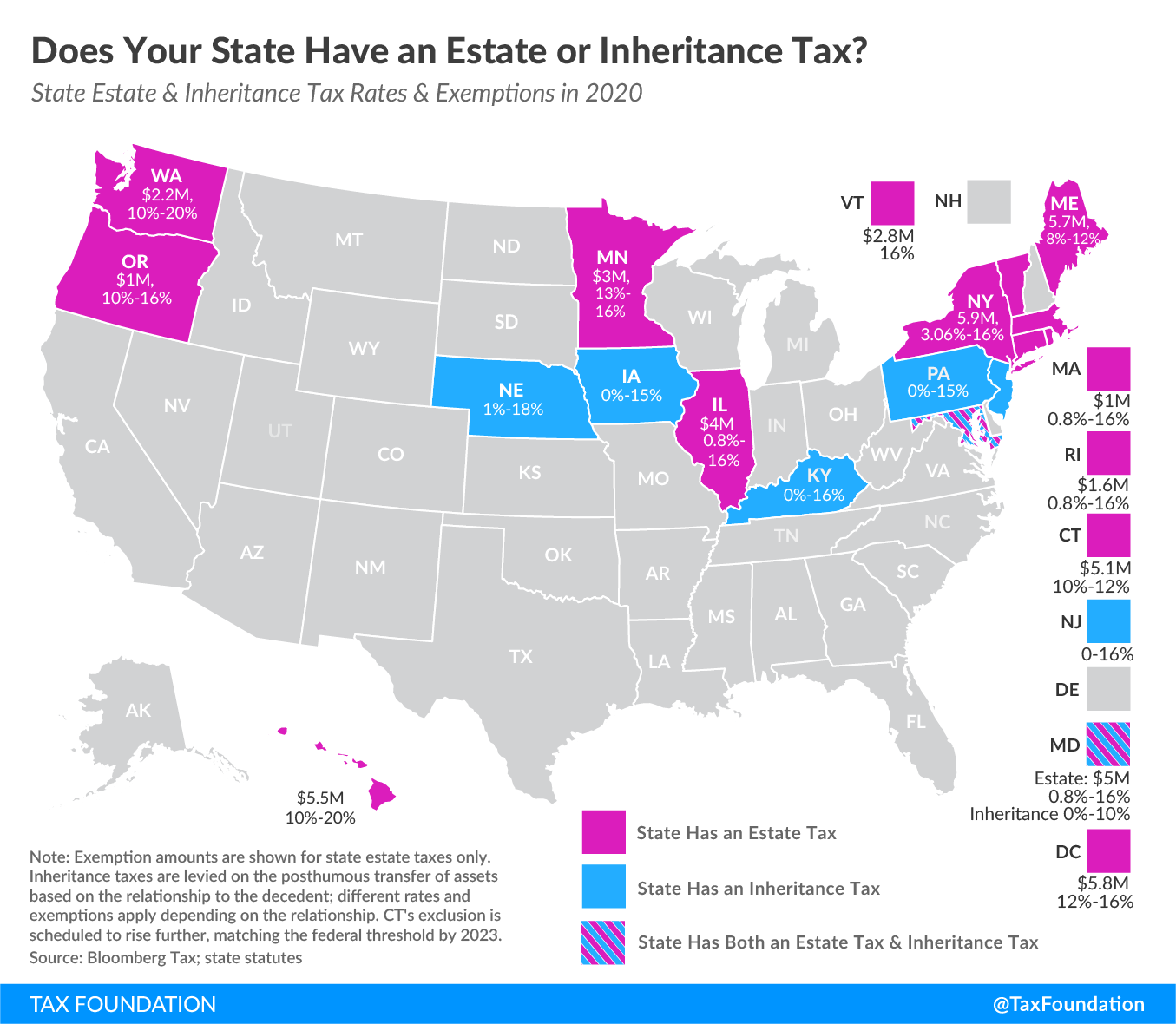

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, What to know about the recent change to the massachusetts estate tax. Updated on december 21, 2023.

Source: wealthfit.com

Source: wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, But to the extent they. Learn what is involved when filing an estate tax return with the massachusetts department of revenue (dor).

Source: inheritancetaxcalc.com

Source: inheritancetaxcalc.com

Massachusetts Inheritance Tax Calculator Accurate & Free, Governor maura healey signed a tax relief package into law on october 4, 2023, making changes to how the massachusetts estate tax is calculated, as well as several changes. Massachusetts has an estate tax but does not have an inheritance tax.

Source: taxfoundation.org

Source: taxfoundation.org

State Inheritance and Estate Taxes Rates, Economic Implications, and, Senate tax relief compared to the house proposal, the plan from senate democrats suggests a more limited child and dependent. In a significant move, the massachusetts legislature has voted.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, January 10, 2024 | insights; If you're a resident of massachusetts and leave behind more than $2 million (for deaths occurring in 2024), your estate might have to pay massachusetts estate tax.

Source: www.smartwill.app

Source: www.smartwill.app

How much inheritance tax do I have to pay? Smart Will, Rich may, kennedy cameron, danielle justo. In 2023, massachusetts finally increased its estate tax threshold, although barely.

Source: worthtax.com

Source: worthtax.com

A Quick Look at Inheritance Taxes (Video Blog), In massachusetts, this tax amounts to $4.56. They were not taxed either during life or at death.

Governor Maura Healey Signed This Legislation Into Law On Wednesday, October 4.

Massachusetts doesn’t have an inheritance tax, but some residents of massachusetts and nonresidents with.

They Were Not Taxed Either During Life Or At Death.

This guide covers how to file and pay your estate tax return;.