401k Income Limits 2025. The 401(k) contribution limits for 2025 provide ample opportunities for individuals to save for retirement. In 2023, the most you can.

In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit. Matching contribution limits and absolute limits.

Total 401 (K) Plan Contributions By An Employee And An Employer Cannot Exceed $69,000 In 2024.

For example, in 2017, the.

How Much Will The Maximum 401(K), 403(B), And 457 Deferrals For Defined Contribution Plans Rise In 2025?

That’s an increase from the 2023 limit of $330,000.

401k Income Limits 2025 Images References :

Source: jenellewariela.pages.dev

Source: jenellewariela.pages.dev

Irs 401k Catch Up Limits 2024 Terra, For people aged 50 and older who are. The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000.

Source: merriellewanitra.pages.dev

Source: merriellewanitra.pages.dev

2024 Ira And 401k Limits Shea Florette, If you are 50 or older, you can defer paying income tax on $30,000 in your 401(k) plan. More than this year, if one firm’s forecast is any.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2024 Meld Financial, The irs will lift the maximum contribution limit to employee 401 (k) accounts by $2,000 next year to $22,500. Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

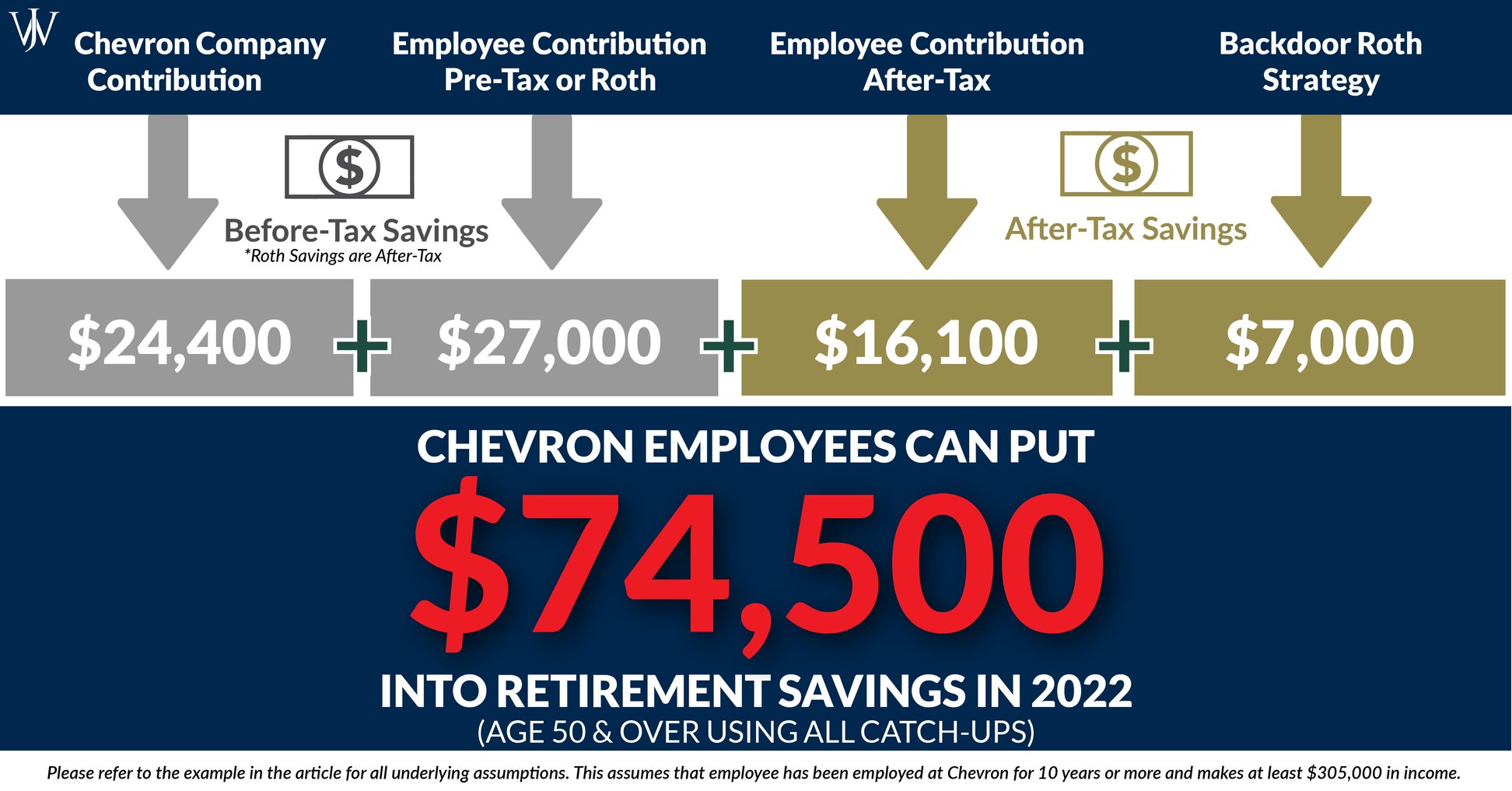

401(k) Contribution Limits & How to Max Out the Chevron Employee, Defined contribution retirement plans will. The irs will lift the maximum contribution limit to employee 401 (k) accounts by $2,000 next year to $22,500.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

How Much Should I Have Saved In My 401(k) By Age 25, 30, 35, 40, 45, 50, Max 401k contribution 2024 over 50 goldi melicent, for 2024, an employee can contribute a. For people aged 50 and older who are.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, In 2024, employees under age 50 can contribute a. The 401 (k) contribution limit for 2024 is $23,000.

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs. 401(k) A Side by Side Comparison, Max 401k contribution 2024 over 50 goldi melicent, for 2024, an employee can contribute a. Most people don't max out their 401(k).

Source: shawneewklara.pages.dev

Source: shawneewklara.pages.dev

401k Matching Limits 2024 Cyndy Doretta, Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs. The tcja created new, lower tax rates and increased the income thresholds before each new marginal tax bracket applied.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, In 2023, the most you can. In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Source: bathshebawhedwig.pages.dev

Source: bathshebawhedwig.pages.dev

What Is The Limit On 401k Contributions For 2024 Raf Leilah, For 2024, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025?

401(K) Contribution Limits In 2023 And 2024.

How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025?

In The Case Of Most 401(K) Plans And.

The 401(k) contribution limits for 2025 provide ample opportunities for individuals to save for retirement.